House Bill

H.R. 324

PPP Shell Company Discovery Act

Primary Sponsor

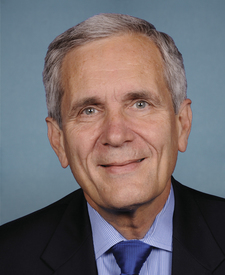

Lloyd A. Doggett

Representative

Cosponsors

0

Quick Stats

Policy Area

Summary

This bill requires the IRS to compile lists of Paycheck Protection Program loan recipients whose loans were forgiven. Specifically, the IRS must identify recipients who did not withhold payroll taxes in 2019 and recipients whose PPP loan amounts exceeded four times their highest monthly wages in 2019. These criteria help identify potential shell companies or fraudulent recipients who may have claimed loans for non-existent or inflated payrolls. The IRS must notify the Department of Justice when lists are complete for potential prosecution.

Latest Action

Referred to the Committee on Ways and Means, and in addition to the Committee on Small Business, for a period to be subsequently determined by the Speaker, in each case for consideration of such provisions as fall within the jurisdiction of the committee concerned.