Senate Bill

S. 2963

Fair Pay for Federal Contractors Act of 2025

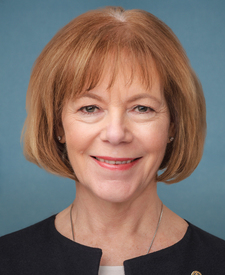

Primary Sponsor

Tina Flint Smith

Senator

Cosponsors

9

Quick Stats

Policy Area

Summary

This bill provides a tax credit to investors who put money into Community Development Financial Institutions (CDFIs). CDFIs are organizations that provide financial services and support to low-income and underserved communities. The tax credit starts at 3% for the first 10 years of investment and then increases to 4%. The total amount of tax credits available is capped at $1 billion in 2022, $1.5 billion in 2023, and $2 billion each year after that.

Latest Action

Read twice and referred to the Committee on Finance.